Founded in 2012, we have continually evolved to meet the diverse needs of our clients. Our experienced team has built an unmatched reputation for providing strategic advice and services across every stage of a project’s lifecycle.

From initial feasibility and strategic planning to structuring joint ventures and overseeing project management and Client handover, SEMZ brings a wealth of experience to every project.

Our services span the full lifecycle—from Property Advisory to Development Management and Project Management. As part of our Property Advisory offering, we’ve developed and implemented successful Property Asset Management Strategies for a wide range of clients.

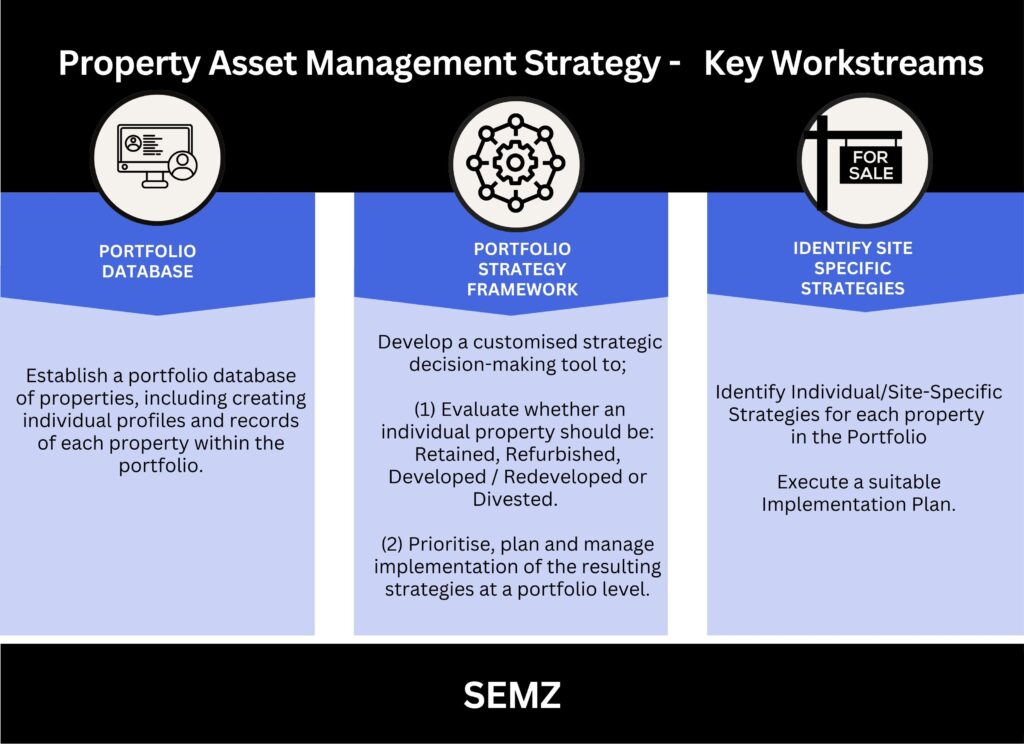

In delivering Property Asset management Strategies, our approach typically focusses on three key workstreams:

Key requirements that are addressed through the compilation of the Portfolio Database include confirming or reaffirming each property’s:

- existing use (i.e. including terms of occupancy, such as lease, license, etc.)

- existing financial and tenancy profile

- age and existing condition

- value

- current outstanding and forecast future maintenance and capital expenditure needs

- redevelopment potential (e.g. site-specific opportunities and constraints)

- current performance, being its overall contribution to service/operational requirements, and organisational and mission-related objectives

- opportunity, being an assessment of its potential to provide a greater contribution to service/operational needs and requirements, organisational and mission-related objectives.

Key requirements to be addressed through the compilation of the Strategy Framework include:

- confirming or reaffirming the client’s business/operational needs, and organisational and non-financial objectives, and how they inform/necessitate the use of property/ies

- developing portfolio-level strategic principles that align with the client’s service/operational needs, and organisational and mission-related objectives for property (for example. a property may be assessed as suitable for retention, refurbishment, redevelopment or divestment according to performance measured against agreed assessment criteria)

- developing workstreams to guide how each of the individual property strategies should be prioritised, implemented, managed, funded and governed (at a portfolio level).

Key requirements of the Individual/Site-Specific Strategies include:

- the results of applying the Strategy Framework

- key site-specific assumptions, risks and opportunities

- lifecycle cost budgets for each property (i.e. broad-based assumptions on outstanding maintenance requirements according to agreed condition assessments, and predefined capital maintenance cost assumptions, refurbishment and replacement costs / options / opportunities)

- high level implementation plans (e.g. scope of works / program / budget).

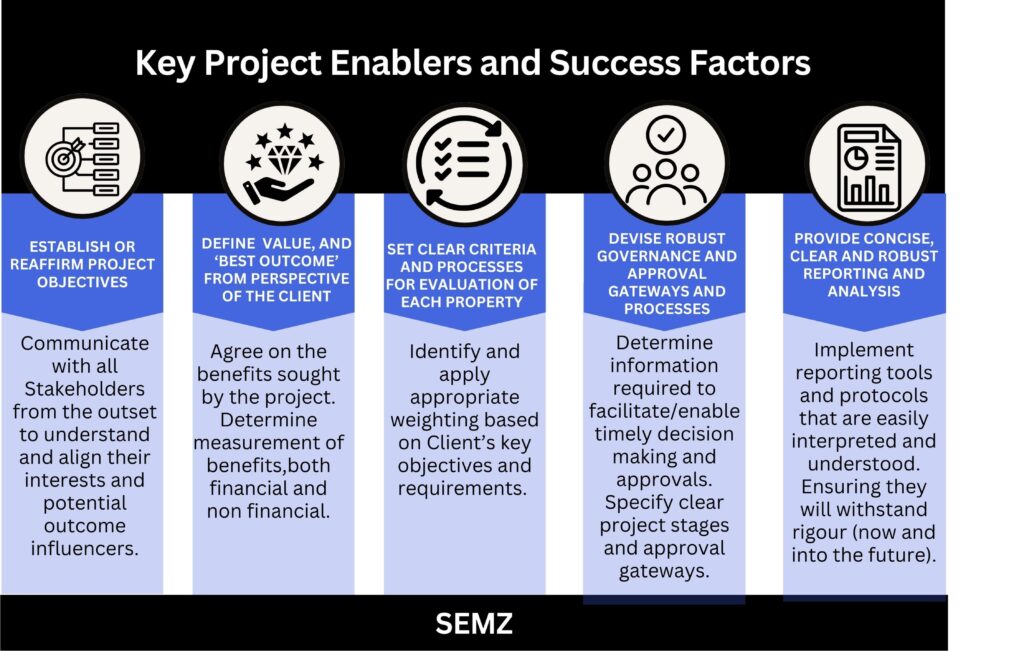

During the initial stage of projects, we typically will facilitate a Project Inception Workshop with key Client stakeholders, which will include a focus on:

- confirming/reaffirming project objectives and associated requirements, our scope of works, program and deliverables

- establishing the project’s governance, reporting and communication protocols, which will likely include work in progress presentations and client approval gateways.

Key Project Enablers and Success Factors

As a part of delivering a Property Asset Management Strategy, the project’s success ultimately rests upon the following key project enablers and success factors:

Our comprehensive approach to Property Asset Management Strategies ensures that every project is aligned with our clients’ unique objectives and long-term goals. By combining detailed portfolio analysis, tailored strategic frameworks, and site-specific strategies, we deliver actionable insights that drive better decision-making and optimal value outcomes.

With a proven track record of helping diverse organisations such as Peninsula Health, Freemasons Victoria, Salvation Army, Temple Society Australia, Slattery Auctions, Uniting Church in Australia, Catholic Archdioceses Melbourne and VMCH, our advice is pivotal in optimising property portfolios while delivering on client objectives.